AI is driving the cost economy, a way of life for many businesses

Cameron Pappa, owner of Norton’s Florists

of Norton

For Cameron Pappas, owner of Norton Florist in Birmingham, Alabama, the artificial intelligence boom is worlds away.

While companies like Nvidia, the alphabet And Broadcom Driving the stock market to new highs and boosting GDP, Papa is experiencing what’s happening in the real economy, far from Wall Street and Silicon Valley.

Small businesses like Norton’s, and companies of all sizes in the retail, construction and hospitality sectors, are struggling from higher costs brought on by the Trump administration’s rate hikes and fewer customers who have cut their spending.

“We just kept an eagle eye on all our expenses,” Pappas, 36, told CNBC in an interview.

Norton made $4 million last year selling flowers, plants and gifts to locals. To avoid price hikes, which could drive away customers, Papa has been forced to get creative by repurposing some of his designs.

“If a bouquet has 25 stems, if you reduce it by three to four stems, you’re able to keep the price the same,” Pappa said. “That’s forced us to really focus on that and make sure we’re pricing things as best as we can.”

Papa’s story and many more like it are being hidden in macro data with the power of AI. In the first half of the year, AI-related capital spending contributed 1.1% of GDP growth, according to September Report from JP Morgan Chase. That spending “outpaced the U.S. consumer as the engine of expansion,” the report said.

Total US GDP grew at an annualized rate of 3.8% in the second quarter of 2025, after falling 0.5% in the first quarter, the Commerce Department said.

US manufacturing costs are Compressed Seven months in a row, according to the Institute for Supply Management. And Construction cost Flat to down due to higher interest rates and rising costs. Cushman and Wakefield said a Report Total project spending for construction in the fourth quarter this month will increase 4.6% from a year ago because of tariffs on construction materials.

The stock market shows the same disconnect between AI and everyone else.

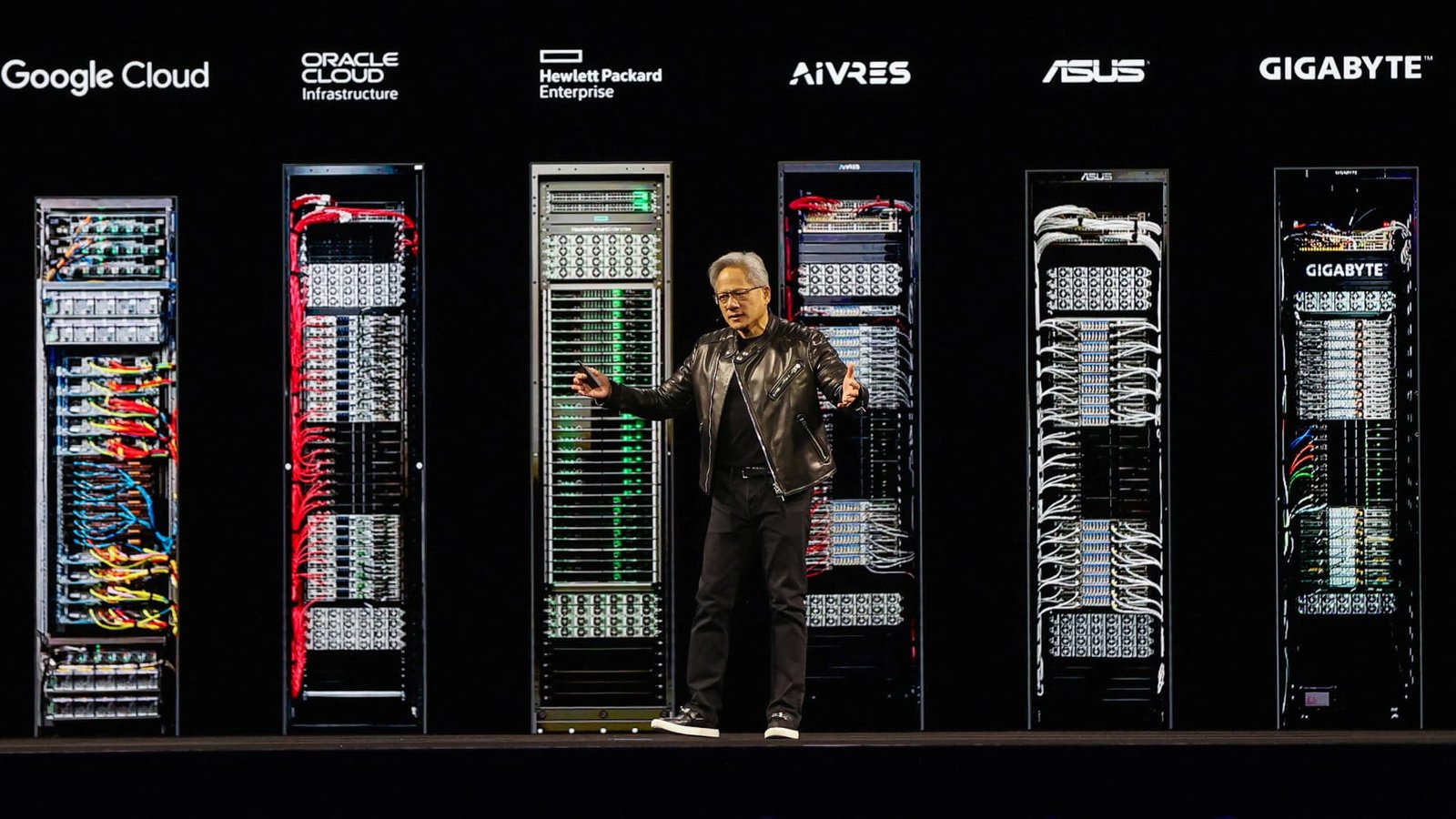

Nvidia CEO Jensen Huang delivered the keynote address for the Nvidia GPU Technology Conference (GTC) on March 18, 2025 at the SAP Center in San Jose, California, US.

Brittany Hosey-Small | Reuters

Eight tech companies are valued at $1 trillion or more and, to varying degrees, are all connected to AI. Those companies – Nvidia, Microsoft, applealphabet, Amazon, Meta, Tesla and Broadcom — make up about 37% of the S&P 500. Nvidia, with a $4.5 trillion market cap, accounts for more than 7% of the benchmark’s value.

Investors seem to be investing heavily in AI infrastructure. Shares of Broadcom are up more than 50% this year after doubling over the past two years, while Nvidia and Alphabet have jumped nearly 40% in 2025.

That explains why the S&P 500 and Nasdaq are up 15% and 20%, respectively, to hit record highs on Friday, even as economic unease from the government shutdown continues.

Meanwhile, the S&P 500 subgroup that includes consumer discretionary and consumer staples companies is up less than 5% year to date.

The latest troubling sign for consumer markets came on Thursday, when target has been told cutting 1,800 corporate jobs — the retailer’s first major round of layoffs in a decade. Target shares have fallen 30% this year.

“I think the message that the AI economy is driving GDP numbers is correct,” Arun Sundararajan, a professor at New York University’s Stern School of Business, told CNBC in an interview. “There may be weakness in the rest of the economy, or no weakness, but more modest growth.”

Investors will be hearing all about AI in the coming days, the busiest part of the quarter for tech earnings, and they’ll be listening closely for additional guidance on capital spending. Meta, Microsoft and Alphabet reported on Wednesday, followed by Apple and Amazon on Thursday.

Nvidia’s stock over the past year.

Last month, Nvidia $100 billion investment In OpenAI, a startup valued at $500 billion. The capital will help OpenAI deploy at least 10 gigawatts of Nvidia systems, equivalent to the annual electricity consumption of roughly 8 million US homes.

shares of Advanced Micro Devices It has doubled this year and is up more than 20% after the chipmaker made the announcement earlier this month Deal with OpenAIWhereas Oracle has been delayed due to its relationship with OpenAI and extensive infrastructure build-out.

“Are we inflating the economy now, setting ourselves up for a future crash?” Sundararajan said. He added that he sees no signs that demand for AI infrastructure will slow down anytime soon.

‘Tariff Price Management’

When it comes to local businesses, most people only know about the AI gold rush from news headlines. One in four small business owners are stuck in “survival mode” as they face challenges like rising costs and rates, according to a September report. Keybank survey. It is a part of the economy that regularly accounts for 40% of the country’s GDP.

Papa’s Flower Shop was established in 1921 and bought by his father in 2002. The business has survived the Great Depression, World War II and the Covid pandemic. Pappa said his father, who died in 2022, reminded him that this period was “just another season” for Norton and that such challenges come with territory.

But Trump’s tariffs create a whole new set of restrictions, as roughly 80% of America’s cut flowers are imported from countries like Colombia and Ecuador. US Department of Agriculture.

Norton has no way to avoid high import costs, but Pappa said he has started buying some flowers directly from South American growers, which saves him money versus being overcharged by distributors.

Pappa said this was part of his “tariff price management” efforts.

Trump’s tariffs will cost global businesses more $1.2 trillion This year, according to S&P Global, and most of that cost is being passed on to consumers.

With the holiday season fast approaching, consumer sentiment is of particular importance. The picture is bleak.

The majority of US consumers, 57%, who responded a Deloitte survey published this month that they expect the economy to weaken next year, down from 30% a year ago. is The most negative outlook since the consulting firm began tracking sentiment in 1997.

Gen Z consumers, ages 18 to 28, said they plan to spend an average of 34% less this holiday season than last year, according to the survey. Millennials, who are between 29 and 44, said they expect to spend an average of 13% less this holiday season.

Additionally, seasonal jobs in the retail industry are poised to decline lowest level Since the 2009 recession, according to a September report from job placement firms Challenger, Gray and Christmas.

left the firm Another report The total for the year so far this year is just under 205,000, a 58% drop from the same period last year, which showed new hires in the US earlier this month.

The Starbucks logo is displayed in the window of a Starbucks coffee shop on September 25, 2025 in San Francisco, California.

Justin Sullivan | Getty Images

Starbucks 1 billion dollars announced Reconstruction plan In September that includes closing several stores in North America. As part of the plan, about 900 non-retail employees were laid off and the company cut other jobs 1,100 corporate workers Earlier this year.

Shares of Starbucks are down about 6% this year.

shares of Wyndham Hotels and Resorts The hotel chain fell on Thursday after it reported disappointing third-quarter results. CEO Geoff Balotti cited a “challenging macro backdrop” to the company’s earnings to leave. The stock is down about 25% year to date.

Even in parts of the tech industry that have benefited the most from the AI boom, companies are cutting back on layoffs. Microsoft announced plans to cut approx 9,000 jobs in July, which the company partly attributed to a reduction in management levels. Salesforce It’s one of several tech companies announcing layoffs, saying AI can now handle the job.

But Hatim Rahman, an associate professor specializing in AI at Northwestern University’s Kellogg School of Management, said most businesses using AI for efficiency won’t find it right away. So companies can’t rely on technology to cope with declining revenues, and Rahman said, “the road ahead is going to be bumpy.”

“AI is not a plug-and-play solution,” Rahman said. “For many organizations, it will involve being able to leverage people, processes, culture, tools. And overall, it will take time.”

See: An AI boom is lifting the stock market, but it may be masking a weak economy

Post Comment