Altcoin Market Drops by $800 Billion as Retail Traders Disappear

The altcoin market is $800 billion smaller than previous cycles suggest, and the shift in retail sentiment may have wiped it out.

A new estimate from 10x Research suggests that the element complex is…Bitcoin Cryptocurrencies have been starved of capital this cycle, largely because retail investors, especially in South Korea, turned to cryptocurrency-related stocks instead, while bitcoin has boomed due to institutional inflows. The estimate comes just weeks after a record liquidation wiped out large swaths of the altcoin market, amplifying fears that the speculative playground for digital tokens beyond Bitcoin and Ether may never recover.

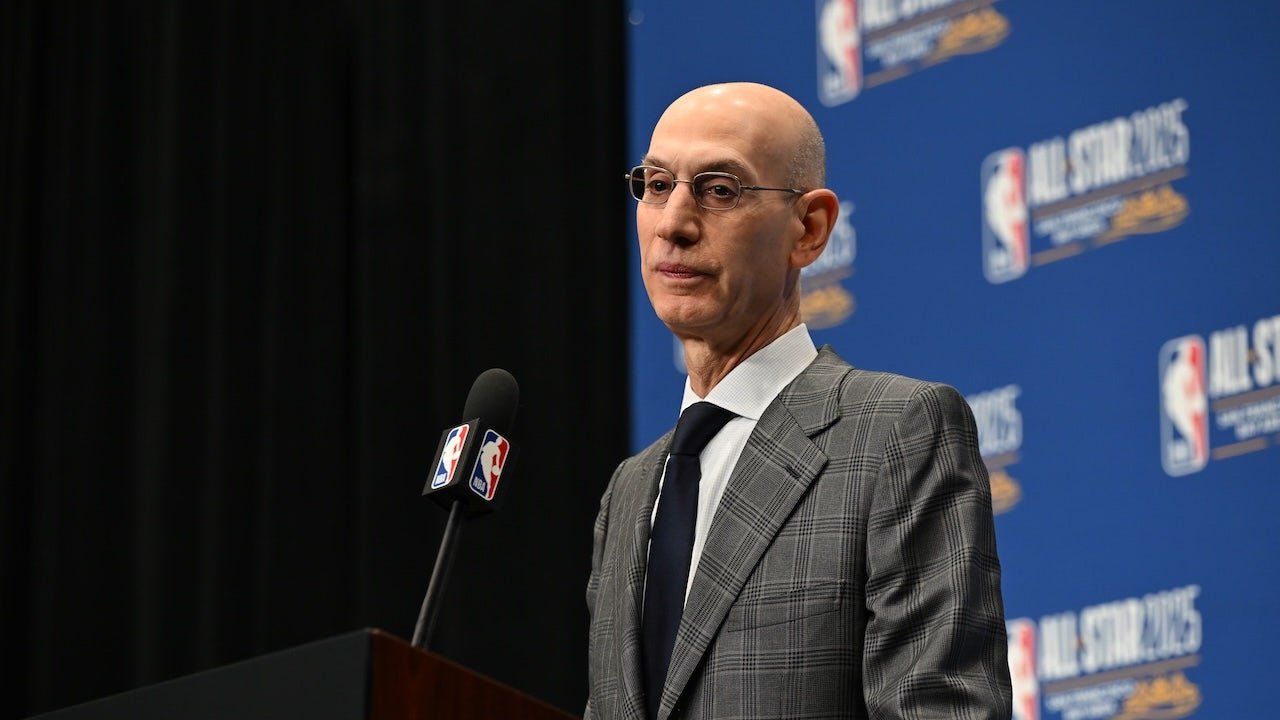

“The market cap of altcoins would have been about $800 billion higher if retail investors — especially in South Korea — had not redirected their attention toward crypto-related and other stocks,” he said. Marcus ThelenCEO and Head of Research at 10x Research. He added that in this cycle, “altcoins have failed to attract enough new capital.”

Historically, cryptocurrency traders in South Korea have shown an affinity for altcoins, which in the past accounted for more than 80% of the total trading activity on local exchanges. This is a stark contrast to global platforms, where Bitcoin and Ether together make up 50% or more of total volumes.

In 2024, from November 5 to November 28, the average daily trading on Korean cryptocurrency exchanges I reached To about $9.4 billion, compared to $7 billion for the KOSPI, according to data from CCData and Korea Exchange. Since then, volumes have collapsed, according to 10x Research.

Low appetite among Korean traders is a major factor in the poor performance of altcoins, and may herald further declines, 10x said.

The recent sharp sell-off in cryptocurrency markets, sparked by escalating trade tensions between the US and China, sent both Bitcoin and altcoins higher, but altcoins were the hardest hit on a relative basis. Of the $380 billion surveyed, about $131 billion was concentrated in altcoins, 10x said at the time.

For altcoins, the shift in interest in bitcoin and cryptocurrency stocks represents a “structural shift,” according to the 10x report — a deficit that seems unlikely to be made up anytime soon.

The MarketVector index, which tracks the bottom half of the 100 largest digital assets, rose 4% this week, after falling 23% the previous week. The index fell by 57% this year. Bitcoin rose about 3.7% this week to about $111,000, and is 18% higher since December.

Post Comment