Chief Economist on the Dirty Truth of Economics: The Only People Who Are Satisfied Are ‘Earning More Than $200,000’ and ‘Have Large Stock Portfolios’

Inflation may rise more slowly than expected, Markets may be cheeringThe Fed is likely to cut interest rates soon, but Diane Swonk isn’t popping champagne.

the Veteran economist He says the economy “looks better than it looks” because the data used to measure it is eroding, and the illusion of resilience could dissipate heading into the fourth quarter.

“The only groups that feel good about the economy right now are those making more than $200,000 in surveys and have large stock portfolios,” Swonk said.

Consumer Price Index for September Show A monthly rise of 0.3% and an annual rate of 3%, with the underlying index – which the Fed watches more closely than the headline – rising 0.2%. Economists were expecting a slightly hotter reading, anticipating a 0.4% monthly increase in the headline CPI and a 0.3% increase in the core rate.

Although the inflation rate came in below expectations, it was still rising year-on-year, with September’s pace accelerating from 2.9% in August. The CPI has now risen to its highest level since January. Inflation slowed steadily through the spring, reaching just 2.9% in May and June, before accelerating again due to rising energy costs.

Once again, energy costs were the main driverWith gasoline rising 4.1%, while food prices fell and core inflation – excluding food and energy – slowed to 0.2%. Markets welcomed the result as a sign that inflation remains under control, boosting expectations for another quarter-point Fed rate cut at next week’s Federal Open Market Committee meeting and another in December.

But Swonk, chief economist at… KPMGHe sees something else: a slow-moving problem that is partly statistical, partly structural, and increasingly psychological.

“It is a rise, not a rise,” she said, noting that the headline figure hides the continued “stationarity” in service sector prices and a widening division among those who actually feel comfortable.

She claims that beneath the surface, the United States is on shaky foundations, both economically and in terms of the quality of data that guides policymakers.

A false sense of calm

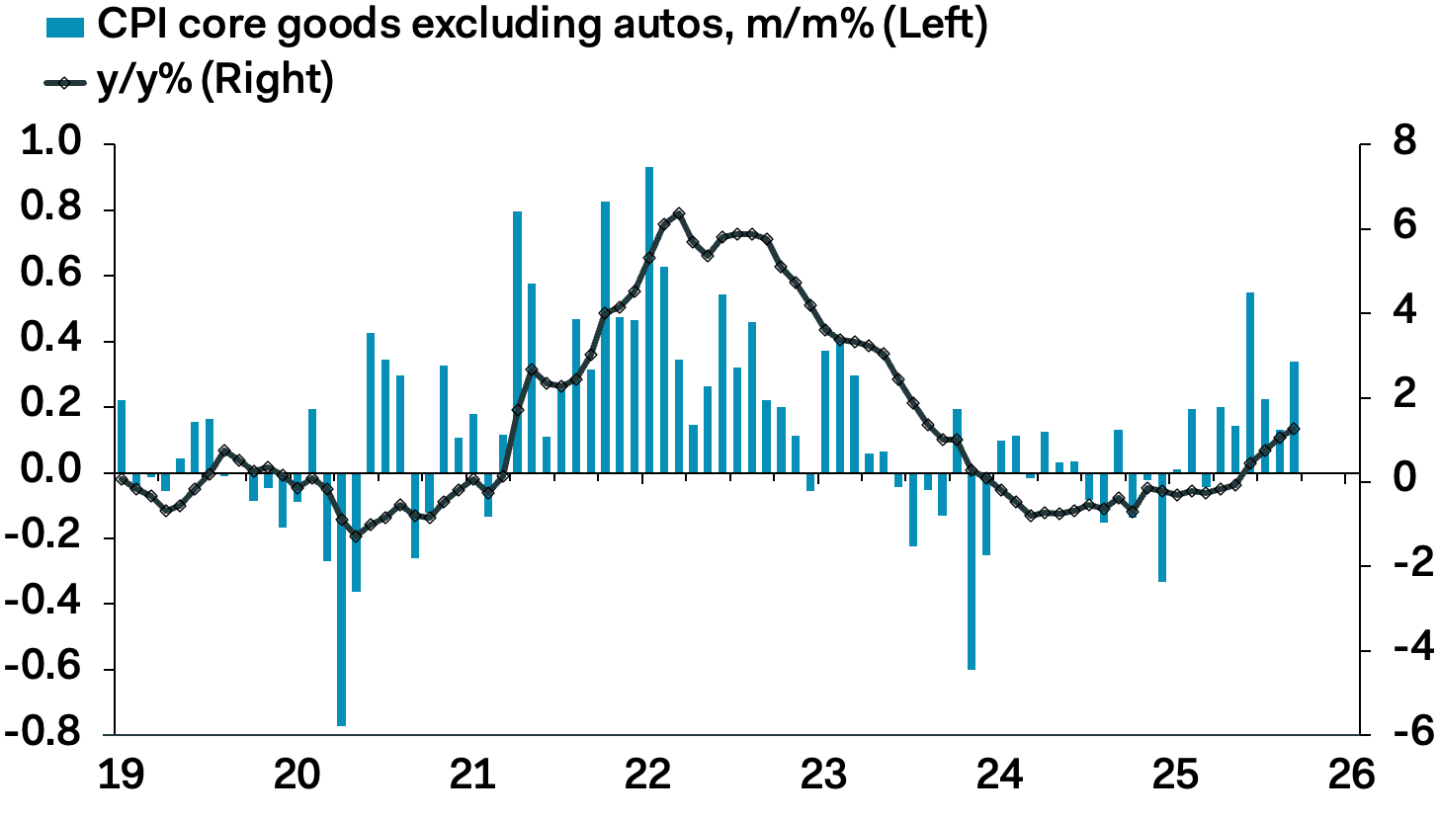

Swonk noted that many categories that keep inflation stable are either insulated from tariffs or benefit from temporary exemptions: computers, smartphones and some vehicle imports. Once those fade, “commodity prices will continue to rise,” she said, with little sign of broad-based inflation falling. Less sheltered essential services — a measure the Fed closely monitors — rose about 0.4% in September, according to Swonk estimates, and are still more than 3% higher than they were a year ago, “far higher than anything we saw before the pandemic.”

She warns that this stickiness is magnified by a bifurcated consumer base, which some economists have called “inflation.” “The economy is K-shapedWealthy households continue to spend freely on travel, entertainment and premium goods, making inflation in the services sector stubborn. In contrast, low- and middle-income consumers are holding back, trading at discounts, increasing their budgets, or delaying purchases altogether.

“Retailers feel this divide,” Swonk said, describing the landscape. Discount chains are seeing higher-income shoppers while Mortgage delinquencies creep up Among those with thinner financial cushions.

The result is an overall inflation rate that understates the amount of pain endured by the average family.

“People make tough trade-offs in their baskets,” Swonk said. “The economy looks better on paper than it does for the majority of Americans.”

The hidden fragility of data

Swonk also believes that part of this gap between reality and perception stems from the government’s diminished ability to collect and verify data. Even before the government shutdown that delayed the release of the CPI by nine days, the Bureau of Labor Statistics was operating with about 20% fewer employees than before the pandemic, Swonk said. DOGE budget cuts. This means that more than a third of the price data in the CPI now exists attributed– They are estimated rather than directly monitored – since fewer agents collect prices in person.

“We’re comparing something similar in price, but it’s not apples to apples,” she said. “You don’t have a lot of people in the field taking those samples.”

This means that official inflation readings may be smoother than the fluctuations consumers face in the real world, especially for categories where domestic price fluctuations or shortages are more important, such as in beef prices.

For the Fed, this represents a serious blind spot. Policymakers rely heavily on inflation data to calibrate interest rate cuts, and if the CPI is based on incomplete samples, this risks reinforcing the perception that inflation is falling more quickly than it actually is.

“These numbers are still not entirely clear,” Swonk cautioned. “The problem is not the closure. It is the staff shortage we were facing.”

For Swonk, the slow collapse in how we measure the economy itself is almost the bigger story than monthly inflation. When asked if she was concerned that markets and the broader American consumer might become skeptical of the BLS, or even accuse the bureau of politicization, Swonk sighed wearily.

“Trust in data has actually been eroding for decades,” Swonk said. “Now it’s accelerating.”

We have a harder road ahead

Looking ahead, Swonk expects the economy to slow “significantly” in the fourth quarter, a turnaround she says was already coming before the shutdown drained 750,000 federal payrolls from the economy. Consumer pressures, rising payment delinquencies, and the passage of tariffs will collide with a fragile labor market and a weaker retail season.

“We are heading into a very difficult holiday season,” she said, noting that surveys show that consumers “want cash more than anything else,” which reflects financial anxiety, not confidence.

The government’s tariff exemptions may mitigate some of the price increases, but it expects varying impacts across sectors. Many of the price pressures associated with tariffs “are still ahead of us,” Swonk said.

Post Comment