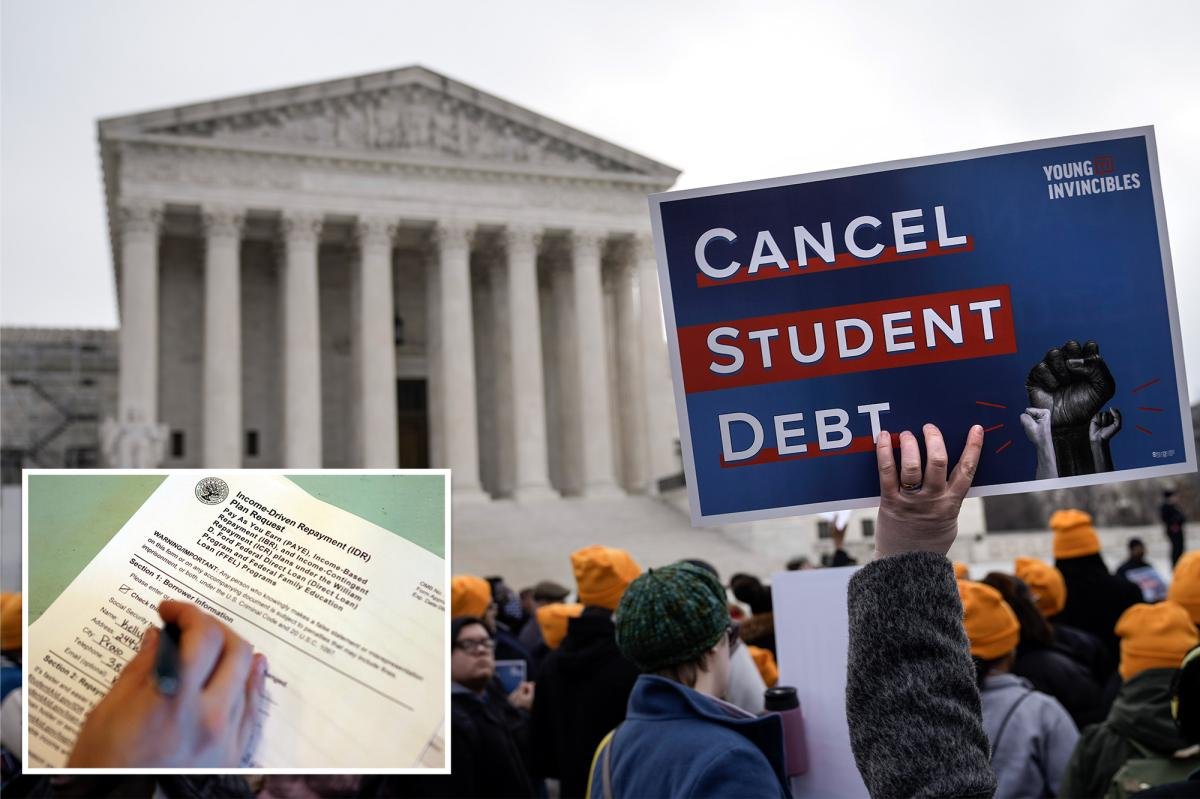

Millions of borrowers will be forgiven student loan debt under new Trump administration agreement — here’s how to know if you’re one of them

Millions of student loan borrowers will see “light at the end of the tunnel” after the Trump administration agreed to reinstate loan forgiveness plans it partially blocked after a court battle.

Trump administration An agreement was reached with the American Federation of Teachers To agree to cancel student debt for millions of borrowers who continue to make their regular payments.

The AFT and the Department of Education reached an agreement Friday to begin canceling student loans for borrowers enrolled in income-driven repayment plans, according to a joint status report filed the same day.

“This is a huge win for borrowers,” said Winston Berkman Breen, legal director of Protect Borrowers, which served as counsel to the teachers union. “With applications filed today, borrowers can relax a little bit.”

In a lawsuit filed in March, the AFT — which has about 1.8 million union members — accused Trump officials of blocking federal student loan holders from accessing repayment and forgiveness programs that were in place when they first borrowed.

The White House had paused student loan forgiveness under some income-driven repayment plans — which calculate borrowers’ monthly payment based on their paychecks — earlier this year.

After meeting a certain number of months of qualifying payments in an IDR plan, borrowers can usually have the remaining balance of their loans forgiven.

Trump’s Education Department — led by Linda McMahon — said it could block these programs because of a court order temporarily halting the Biden-era Savings on a Valued Education Plan, or SAVE, another income-driven repayment program.

The temporary blocks left borrowers with only one repayment plan option resulting in loan cancellation, known as an income-based repayment plan, or IBR.

After months of legal battles, the Trump administration changed its position and allowed the programs to return under an agreement on Friday.

“For nearly a decade, the AFT has fought to free the rights of student loan borrowers from the shackles of unfair debt — and today, much of the affordability battle has been vindicated,” Randi Weingarten, president of the AFT, said in a statement.

“This year, we stood up to the Trump administration when it refused to follow the law and denied borrowers the relief they were owed. Our agreement means that these borrowers stuck in limbo can either get immediate relief or finally see the light at the end of the tunnel.”

Here’s how to find out if you qualify for student loan forgiveness.

Who is eligible for student loan forgiveness?

The agreement covers all enrollees in income-based repayment, income-contingent repayment, income-based repayment plans, and the Public Service Loan Forgiveness Program, AFT. He said in a press release.

Eligible borrowers must make a specific number of the minimum payments required under their repayment plans before their debt is forgiven.

The Trump administration also agreed to provide refunds to borrowers who made additional payments after their eligibility date for cancellation through income-driven repayment.

Additionally, the government will process repo requests for IDR and PSLF, including requests from partially cash-strapped borrowers, a requirement eliminated under Trump’s Big Beautiful Act.

How to check if you’re enrolled in a qualifying plan

For federal student loans, individuals can log into their account at StudentAid.gov and select “Help Me” or “View Details” to locate their loan details.

There, borrowers can see each loan and its specific repayment plan to check if it is one of the plans that provides loan forgiveness.

Will borrowers be taxed on canceled debt?

Under Friday’s agreement, the Trump administration confirmed that borrowers who become eligible for student loan forgiveness this year will not owe federal taxes on the forgiveness.

It also addressed the issue of a potential tax penalty on borrowers whose debts were forgiven next year due to the delay.

Under current tax law, borrowers whose loans are repaid in 2026 and later would be taxed on the forgiven amount as if it were regular income — a significant burden that could amount to thousands of dollars.

Under the new agreement, the Department of Education will recognize the original date on which a borrower becomes eligible to have their debt canceled under an IDR plan, rather than the date on which the government processes it.

This means that borrowers who qualify on or before December 31, 2025, will not be hit with a surprise tax bill due to processing delays caused by the court battle or government shutdown.

The union said the deal also addresses what it called a looming “tax bombshell” stemming from a 2026 change in federal tax law that will treat canceled debts as income.

When will student loan forgiveness take effect?

The joint agreement is still awaiting court approval to become legally binding.

If the court signs off, the department will be required to submit six monthly reports on the status of the IDR and PSLF application and loan cancellation processing.

If approved, the agreement could provide relief to borrowers across the country who have been stuck in student loan repayment programs for decades.

The timeline for court approval is not immediately clear.

Post Comment