The US government shutdown means investors are turning a blind eye when it comes to high-quality data – and they like it that way

- The US government shutdown halted federal economic data collection. Leaving investors without formal employment or inflation numbers. Despite the blind flight, markets remain optimistic as stocks approach record highs. Gold fell sharply. Third-quarter earnings estimates look strong, supported by investment in artificial intelligence.

S&P 500 futures rose marginally this morning after the index closed flat yesterday, near its all-time high. Markets in both Europe and Asia were higher or flat this morning as well. Gold, a traditional safe-haven asset that has risen by 55% since the beginning of the year so far, lost 5.3% yesterday, its largest decline in five years.

In other words, investors appear to be shifting from risk-off positions to risk-on positions.

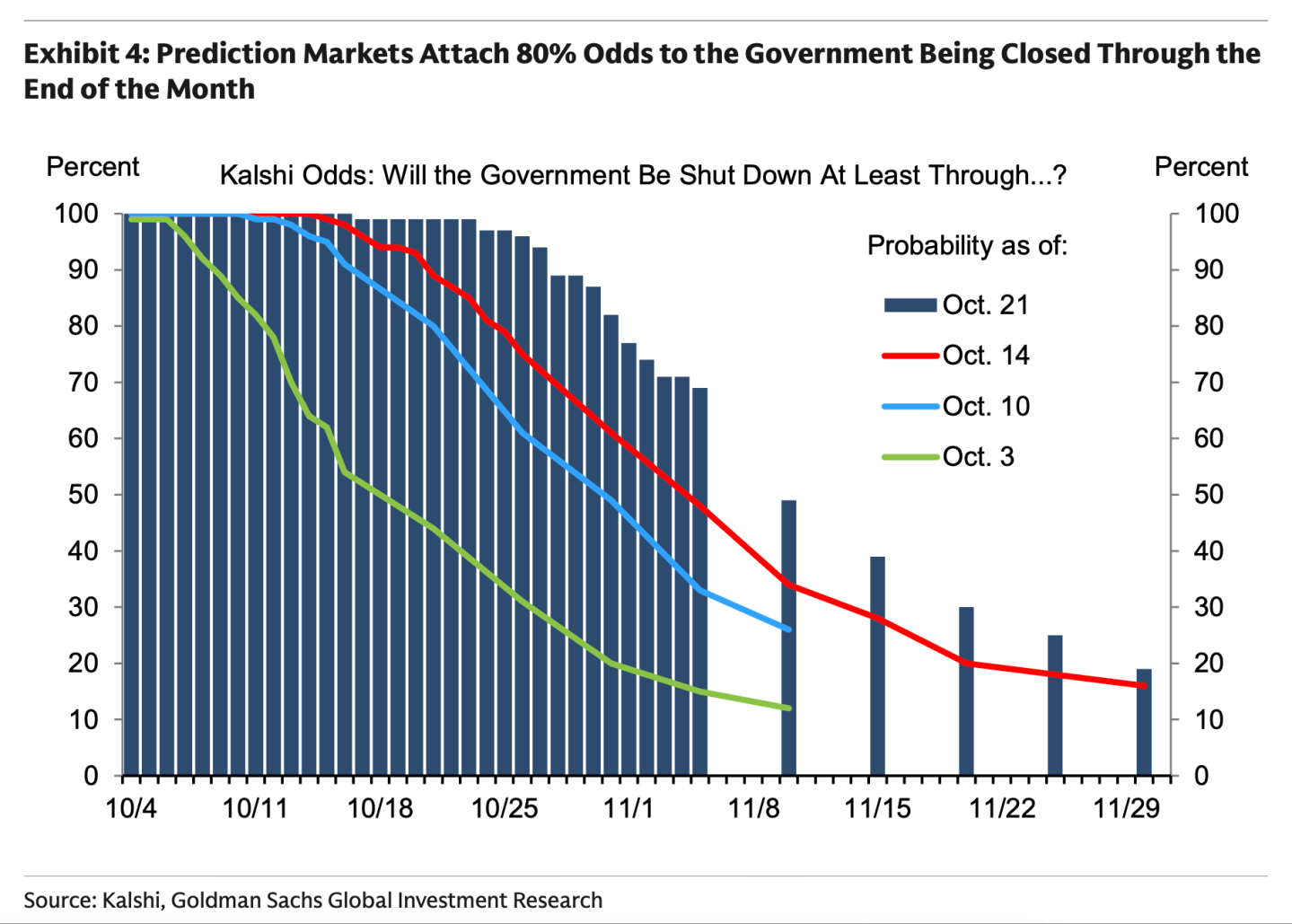

One interesting aspect of this is that the ongoing US government shutdown will likely prevent the Bureau of Labor Statistics from collecting October data on employment and inflation, according to Ronnie Walker and his colleagues at Goldman Sachs.

This means that investors are currently flying aimlessly when it comes to high-quality macroeconomic data – and they seem to be enjoying the view.

“The collection and release of nearly all federal economic data has been delayed until after the government shutdown ends. “The potential impact of the shutdown on the quality and availability of the October employment report and CPI depends on what data can be collected retrospectively,” Walker wrote in a note to clients.

“The close appears to be the most problematic for the quality of the CPI. While the use of alternative data means that prices can be collected retrospectively for series that make up 10-20% of the basket, the vast majority of CPI quotes are hand-collected and are aggregated almost evenly across the calendar month,” he said.

Among the options available to the BLS are to attempt to collect data retrospectively, estimate the data, or simply leave a gap in the data – which would affect economists’ ability to correctly calculate averages for a set of data series.

Private data surveys are not good, according to Samuel Toombs and Oliver Allen of Pantheon Macroeconomics: “The absence of official data during the federal government shutdown shines a brighter light on monthly surveys of businesses and consumers. Some of these surveys contain indicators that correlate well with official data on employment, prices, wages and capital expenditures, but they are generally used as a guide.” for gross domestic product.

In the absence of data that might throw cold water on the party going on in stocks at the moment, third-quarter earnings reports will likely lift stocks further.

Dubravko Lakos-Bojas and his team at JP Morgan estimate that S&P 500 earnings will grow by 12% once all companies report results. “US companies should continue to deliver superior earnings growth supported by a strong AI investment cycle, sustained deficit spending, and a still resilient consumer. We expect the S&P 500 to deliver another quarter of double-digit earnings growth (~12%), driven by above-trend growth from the 30 AI companies (Q3 consensus of 25: 14%) and S&P 470 rebound growth (3Q25 consensus at ~4% vs. 4%). 2024 at -0.4%).”

Here’s a quick snapshot of the markets before the opening bell in New York this morning:

- Standard & Poor’s 500 futures It rose 0.11% this morning. The index closed stable in its last session.

- Stokes Europe 600 It was flat in early trading.

- FTSE 100 index in the United Kingdom It rose by 0.83% in early trading.

- Japan’s Nikkei 225 It was flat.

- China CSI 300 Decreased by 0.33%.

- South Korea Cosby It rose by 1.56%.

- India stylish 50’s It was flat before the end of the session.

- Bitcoin It was flat at $108,000.

Post Comment