These two states will determine whether the US slides into recession while another state enters the danger zone, the chief economist says

The US economy can still avoid a recession, but just barely, and its fate will likely fall to California and New York, according to Moody’s Analytics chief economist Mark Zandi.

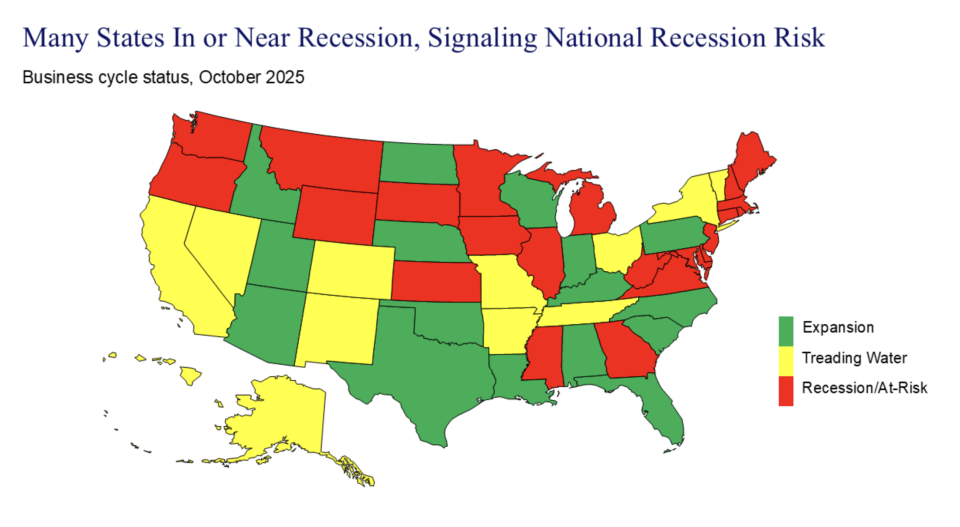

in Social media posts on WednesdayHe reiterated his warning that states, which account for nearly a third of the nation’s gross domestic product, are already in recession or at high risk. The other third is “treading water,” while the rest is still growing but experiencing less momentum.

While his latest assessment largely echoes that What did he say in the summer? and Earlier this monthZandi moved the leading industrial state of Michigan from the “running waters” list to the “stagnating” list.

This comes as President Donald Trump’s tariffs continue to impact automakers that support the state’s economy. while GM Ford reported upbeat third-quarter earnings last week, but it still sees billions of dollars in tariff-related costs.

Meanwhile, supply chain disruptions – including China’s restrictions on rare earth exports in response to Trump’s trade war – have also affected production.

“This state-level picture reflects the national trend: The U.S. economy is not in a recession, but it is struggling to avoid one,” Zandi wrote. “This is evident in the labor market, where payroll job growth is almost at a standstill and will likely look weaker after all data revisions are made.”

He added that the construction, manufacturing, technology, finance, government and professional services sectors are shedding jobs, while a few sectors, namely health care and hospitality, are still increasing payrolls.

Earlier this month, he sounded the alarm about the job market, saying it was Weak and getting weaker Private sector data sets indicate no job growth in September.

Here’s how the states and one federal district work

- separation: Recession/high risk

- (23): Wyoming, Montana, Minnesota, Mississippi, Kansas, Massachusetts, Washington, Georgia, New Hampshire, Maryland, Rhode Island, Illinois, Delaware, Virginia, Oregon, Connecticut, South Dakota, New Jersey, Maine, Iowa, West Virginia, Michigan, District of Columbia*. tread water

- (12): Missouri, Ohio, Hawaii, New Mexico, Alaska, New York, Vermont, Arkansas, California, Tennessee, Nevada, Colorado. expansion

(16): South Carolina, Idaho, Texas, Oklahoma, North Carolina, Alabama, Kentucky, Florida, Nebraska, Indiana, Louisiana, North Dakota, Arizona, Pennsylvania, Utah, Wisconsin.

Moody’s Analytics

Right now, economic superpowers California and New York are teetering in the water, but they could easily tip the scales. The Golden State alone accounts for a whopping 14.5% of US GDP, while the Empire State accounts for nearly 8%.

Both face opposing trends that may ultimately determine how the business cycle evolves, Zandi noted.

“Whether the national economy is in a recession seems to depend on the large economies of California and New York,” he explained. “Neither economy is in a recession, but both are struggling to gain momentum.” “Deglobalization, including the trade war and highly restrictive immigration policy, are headwinds to growth, but artificial intelligence and the support it provides to investment, the stock market, household wealth, and spending are tailwinds to growth.” To be sure, the overall economy has been expanding at a strong pace. the GDP tracker from the Federal Reserve Bank of Atlanta

Growth in the third quarter appears to indicate 3.9%, which actually represents an acceleration from the 3.8% growth in the second quarter.

At the same time, most statewide data still does not indicate a significant uptick in layoffs, and a continued fire- and hiring-free environment. While the government shutdown put several key economic indicators on hold, the Labor Department released the report Consumer price index

For the month of September, which rose but came in below expectations.

This has raised the odds that the Fed will make further interest rate cuts later this year, providing another boost to the economy. But Diane Swonk, chief economist at…KPMG He warned against this on Friday The economy looks better than it feels

Observed inflation continues to creep upward, albeit at a slower pace than expected.

She expects the economy to slow “significantly” in the fourth quarter, a turnaround that was already coming before the shutdown drained 750,000 federal payrolls from the economy. Consumer pressures, rising payment delinquencies and the passage of tariffs will collide with a fragile labor market and weak retail landscape.

“We are heading into a very difficult holiday season,” Swonk predicted.

Post Comment