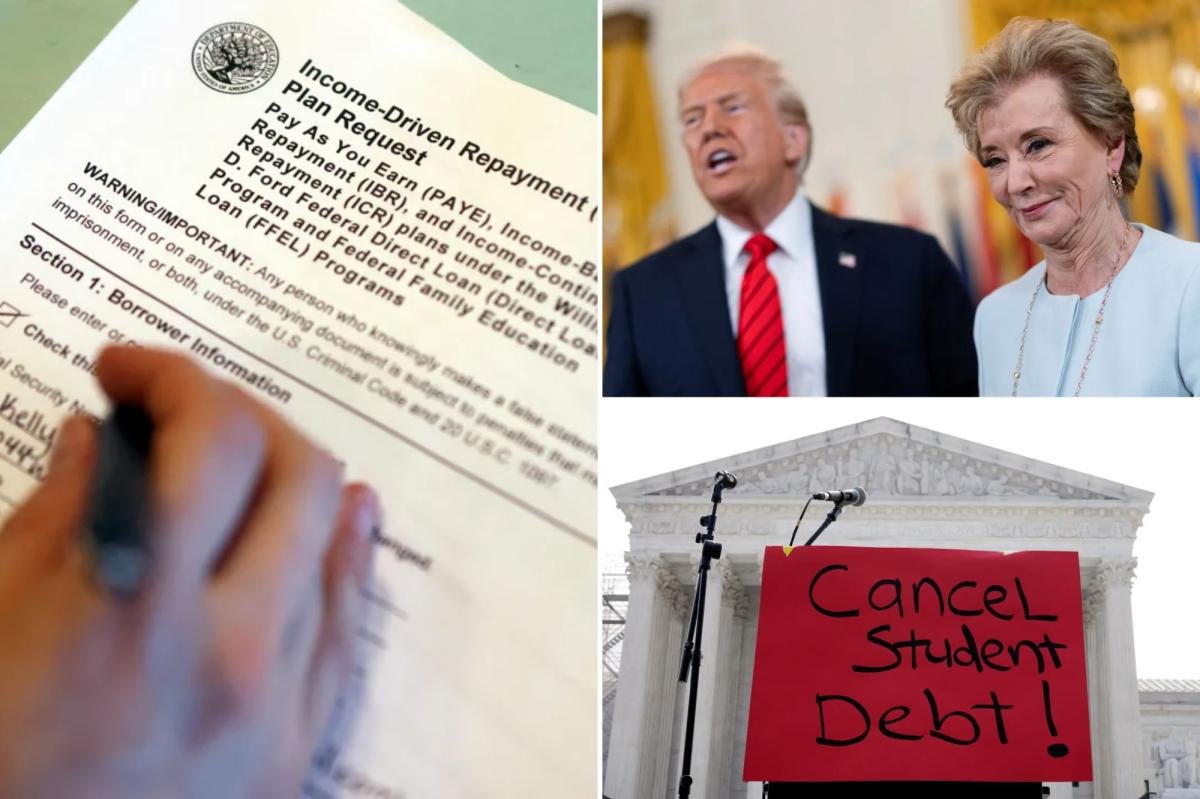

White House agrees to cancel student debt for millions of borrowers

The Trump administration says it is canceling student debt for millions of borrowers — a pivot from its previous moves to block some loan forgiveness plans.

In an agreement with the American Federation of Teachers, the White House will once again begin processing student loan forgiveness for eligible borrowers in two income-based repayment plans — income-contingent repayment and pay-as-you-earn — until they expire.

President Trump’s “big, beautiful bill” is scheduled to phase out these two programs by July 1, 2028. They have a total enrollment of more than 2.5 million people, Estimated higher education expert.

“This is a huge win for borrowers,” said Winston Berkman Breen, legal director of Protect Borrowers, which served as counsel to the teachers union. “With applications filed today, borrowers can relax a little bit.”

“The U.S. Department of Education has agreed to follow the law and provide congressionally mandated affordable payments and debt relief to hardworking public service workers across the country, and we will do so under court oversight. We fully intend to hold them to their word.”

The Trump administration said that under Friday’s agreement, borrowers who became eligible for student loan forgiveness this year would not owe federal taxes on the forgiveness.

The Ministry of Education did not immediately respond to the newspaper’s request for comment.

In a lawsuit filed in March, the AFT — which has about 1.8 million union members — accused Trump officials of blocking federal student loan holders from accessing programs that were in effect when they first borrowed.

Earlier in the year, the White House temporarily halted student loan forgiveness under some income-based repayment plans. These programs calculate a borrower’s monthly payment based on his or her salary, and typically eliminate any remaining debt after 20 or 25 years.

Trump’s Education Department — led by Linda McMahon — said it could block these programs because of a court order halting the Biden-era Savings on a Valued Education Plan, or SAVE, another income-driven repayment program.

The temporary blocks left borrowers with only one repayment plan option resulting in loan cancellation, known as an income-based repayment plan, or IBR.

As Trump’s tax and spending legislation emerged over the summer, consumer advocates warned of potential harm to borrowers.

Limited payment options – including end of savings – It can lead to higher monthly student loan payments For the typical borrower hundreds of dollars, according to an analysis by the nonprofit Student Borrower Protection Center.

Post Comment